Ottawa spent more cash in Alberta than it raised in tax revenues from the province in 2020, economist says

[ad_1]

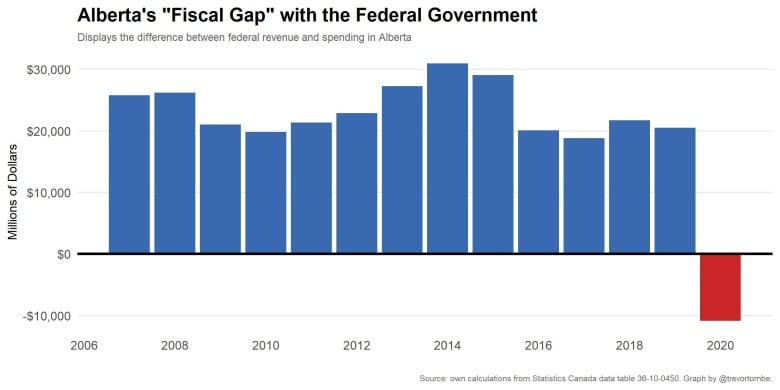

For the primary time in many years, new information from Statistics Canada suggests the federal authorities spent more cash in Alberta than it raised from tax revenues in the province final 12 months, a Calgary economist says.

When the pandemic shuttered companies and diminished work hours throughout Canada in 2020, emergency fiscal help flowed from the Authorities of Canada throughout the nation.

This spending included wage subsidies, lease subsidies, boosted baby advantages, topped-up employment insurance coverage (EI) funds and forgiven mortgage repayments.

Based on numbers launched by Statistics Canada on Monday, Alberta was the biggest recipient of COVID-related federal spending will increase per individual within the nation.

In Alberta alone, the federal authorities additionally spent practically $12 billion in enterprise subsidies, whereas practically 1.1 million Albertans acquired Canada emergency response profit (CERB) funds.

Moreover, there have been additionally transfers from the federal authorities to the Alberta authorities itself, to assist offset some health-related value pressures created by the pandemic.

Whenever you add all of it collectively, it is a couple of $30-billion enhance within the quantity of federal spending in Alberta, in response to economist Trevor Tombe.

“Which is principally double what you usually see in a typical 12 months,” he advised CBC Information.

“What this displays is that federal spending actually ramped up dramatically within the pandemic, and Alberta was truly the biggest recipient of that enhance [per person].”

Albertans benefited considerably: Tombe

There are numerous explanation why Alberta’s economic system usually outperforms different provinces within the nation, in response to Tombe.

Oil and fuel has been a extremely worthwhile trade that generates numerous earnings for shareholders and staff, and royalties to the federal government, as effectively.

However Alberta’s productiveness can be larger general in most sectors than what’s seen in different jurisdictions, Tombe mentioned — partially as a result of it has a youthful inhabitants that yields extra staff.

“In order that does are likely to lead to larger tax funds to the federal authorities, simply because larger earnings means larger taxes, as a result of that is actually an unavoidable consequence of getting an earnings tax,” Tombe mentioned.

“As a result of Alberta is dwelling to a disproportionately giant share of high-income people … Albertans are likely to, on common, pay extra in federal taxes. And that is largely as a result of we’re high-income relative to different provinces.”

Final 12 months, nonetheless, he says the province acquired extra in federal spending than it raised in tax income — a primary since 1965.

“What this tells me is that Alberta, and Albertans, benefited considerably from the federal authorities’s response to COVID,” Tombe mentioned.

“And I feel it reveals among the advantages of being part of a broader federation the place we are able to pool dangers.”

Albertans nonetheless contributed disproportionately, UCP says

Lori Williams, a political science professor at Mount Royal College, additionally mentioned the figures present a greater general image of the fiscal relationship between Alberta and the remainder of the federation.

“And understanding that, it is not fairly as out of stability because it seems, while you simply have a look at one thing like equalization,” Williams mentioned.

Nonetheless, Kassandra Kitz, the press secretary for Alberta Finance Minister Travis Toews, mentioned in an emailed assertion that the share of equalization funds popping out of Alberta nonetheless amounted to greater than it ought to have final 12 months.

“In 2020, 14.4 per cent of federal revenues have been generated in Alberta, effectively above Alberta’s 11.6 per cent share of the nationwide inhabitants,” Kitz mentioned.

“Which means Albertans nonetheless contributed disproportionately to the remainder of the federation. As for web fiscal contribution, in per capita phrases, Alberta was nonetheless the smallest web fiscal recipient amongst provinces in 2020 ($3,189 per capita). This was barely over half the typical quantity for all provinces ($5,858 per capita).”

Kitz additionally mentioned that federal emergency COVID spending was financed by elevated federal debt.

“Merely put, the federal authorities elevated the debt burden on Canadians, and Alberta was nonetheless the smallest web fiscal recipient (in per capita phrases),” Kitz mentioned.

“This federal debt must be repaid and when this occurs, a disproportionate share of this COVID-incurred debt will proceed to come back from Alberta’s taxpayers.”

A fiscal blip

Whereas 2020 was a fiscal blip in some ways, Tombe says, this supplies a bigger image of how Alberta’s economic system weathered the pandemic.

“And it did not truly climate it that effectively,” he mentioned.

The contraction of Alberta’s general economic system in 2020 was 7.9 per cent, Tombe mentioned — a bigger drop in financial exercise than another province.

“We have been hit notably onerous from the pandemic,” Tombe mentioned.

“However one other a part of it’s low oil costs by 2020 actually being a giant blow to the economic system general.”

Kitz, nonetheless, says many financial forecasters — “together with the Convention Board of Canada and a few of Canada’s largest banks” — predict Alberta will lead the provinces in progress this 12 months.

“In 2020, all provinces had unfavorable contributions to the federation, as a result of one-time impacts of COVID and associated federal emergency response measures,” Kitz mentioned.

“When it comes to actual GDP, in Q1 we reported that it’s now anticipated to develop by 6.7 per cent this 12 months. That is up considerably from the expansion of 4.8 per cent anticipated in Price range 2021.”

[ad_2]

Source link

Post a Comment